This comprehensive guide clarifies the often-misunderstood concept of trust ownership, focusing on revocable living trusts (RLTs). We'll demystify legal and beneficial ownership, provide a step-by-step guide to funding your trust, and address potential risks and mitigation strategies.

Understanding the Two Sides of Ownership

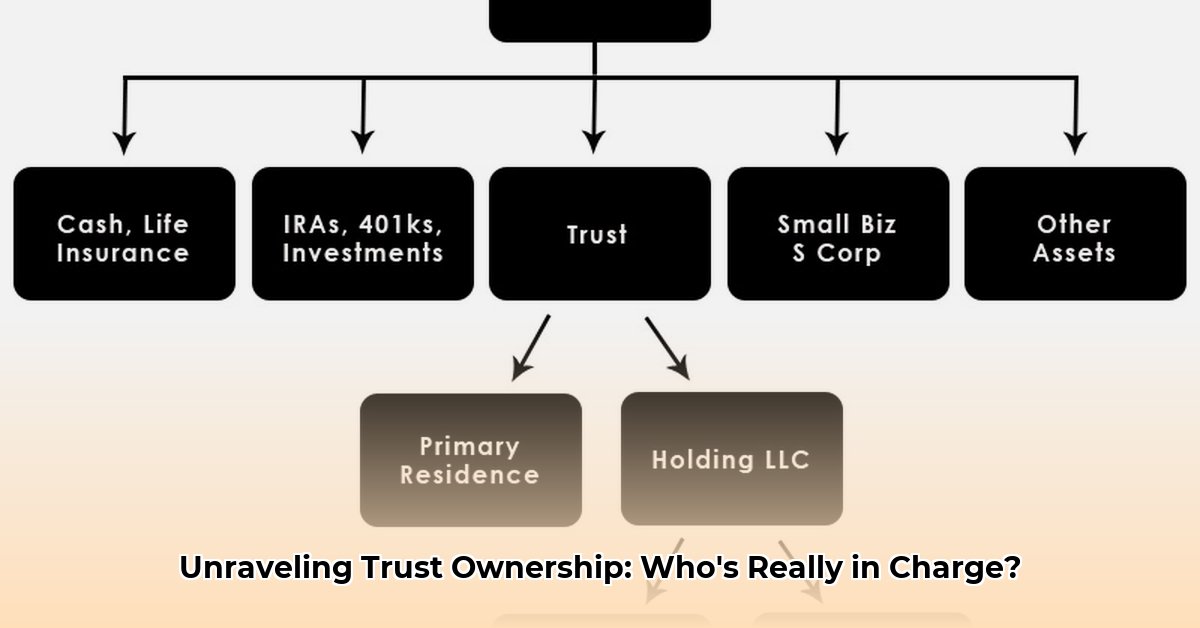

A trust is a legal entity that holds assets separately from your personal ownership. This creates two distinct types of ownership:

- Legal Ownership: The trust itself is the legal owner of the assets. This is reflected in official documents like deeds and bank records.

- Beneficial Ownership: You, as the grantor (the person setting up the trust), are the primary beneficial owner while you are alive. You maintain control and enjoy the benefits of the assets held within the trust.

Think of it like this: the trust is the legal custodian, while you are the beneficiary, enjoying the assets until you decide otherwise or passing on the responsibility according to the trust's terms.

Funding Your Trust: A Critical Step

Properly funding your trust—transferring assets into the trust's name—is crucial for avoiding probate (the court process of distributing assets after death) and realizing the intended benefits of the trust. This isn't a simple process to gloss over.

Here's a detailed, step-by-step approach:

Gather Your Documents: Compile all necessary documentation for your assets (bank statements, investment accounts, deeds, titles, etc.). Thorough organization is paramount.

Retitle Your Assets: Contact relevant institutions (banks, brokers, etc.) to officially transfer ownership of each asset to your trust. Meticulously record every change.

Update Beneficiary Designations: For retirement accounts and life insurance policies, update the beneficiary designation to your trust. This step is often overlooked but crucial.

Review and Confirm: Verify that all assets are correctly titled in your trust's name. Seeking professional review by a legal professional is highly recommended.

The Trustee's Role: Management and Oversight

The trustee manages the assets within the trust according to your instructions. Initially, you, the grantor, are usually the trustee, maintaining complete control. However, you can designate a successor trustee to take over management upon your incapacitation or death. The choice of a successor trustee should be made carefully.

Advantages and Disadvantages of RLTs

Revocable living trusts offer numerous advantages, but it's important to understand the potential drawbacks as well:

| Advantages | Disadvantages |

|---|---|

| Avoids probate, simplifying and accelerating asset distribution. | Can be complex and costly to establish and maintain. |

| Potentially protects assets from creditors (in certain situations). | Requires careful record-keeping and ongoing management. |

| Offers a degree of privacy compared to probate. | Might not be the best choice for everyone's circumstances. |

| Provides control over asset distribution after death. | May necessitate additional tax reporting considerations. |

Potential Risks and Mitigation Strategies

Several risks are associated with revocable living trusts. Proactive mitigation strategies are essential:

| Risk Category | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Improper Funding | High | High | Comprehensive legal counsel; detailed, documented record-keeping. |

| Tax Penalties | Medium | High | Professional tax advice integrated into the planning process. |

| Trustee Mismanagement | Medium | Medium | Selecting a competent successor trustee; regular oversight. |

| Trust Contests | Low | High | Clearly defined and legally sound trust documents. |

| Failure to Review | Medium | Medium | Periodic review and updates to adapt to life changes. |

Navigating the Legal Landscape: Essential Considerations

State and federal laws significantly impact the legal aspects of trusts, including tax implications. Consulting with legal and tax professionals is paramount to ensure compliance and optimize the trust's effectiveness. This step is non-negotiable.

Conclusion: Seek Professional Guidance

While this guide provides a comprehensive overview, the complexities of estate planning demand professional advice tailored to your specific circumstances. Consult with a qualified attorney and financial advisor to create an effective and legally sound revocable living trust. Do not attempt to navigate this process without professional support.